Each of these provides a particular “lens” into the activity in a category. Generally, we’ll look at many of these to make an assessment. To give you an example of what this process looks like, here’s an example about measuring activity in online presence:

Activity in Online Presence

Small businesses can change their online presence in many ways, spanning both content and functionality:

- Adding new delivery options or schedule changes

- Enablement of eCommerce

- Enablement of virtual consultations

- Ramping up digital advertising

We looked at data and information from many sources, internal and external, to identify categories that have been the most active in modifying their websites and/or ramping up their digital advertising.

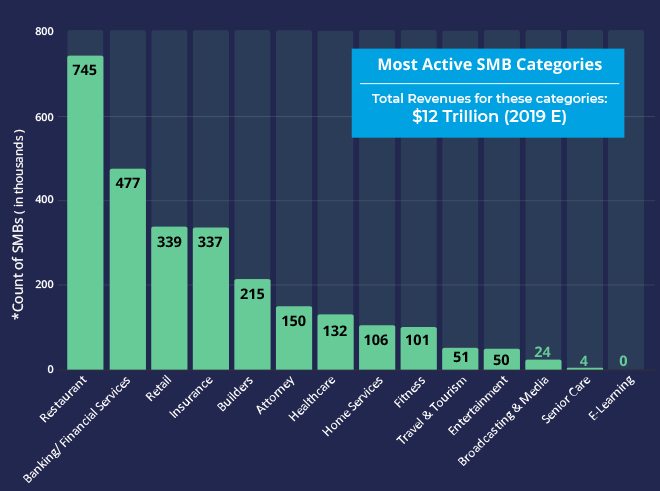

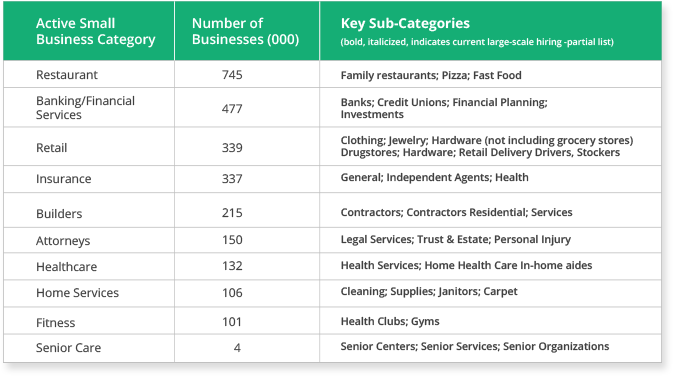

We organized our analysis by business category, starting with top-level categories, and working our way down to granular sub-categories. As shown below, there’s been much activity across diverse categories.

At the top level, we found these categories to be among the most active currently:

A couple of examples

A new category emerges that we call “Support Services”. It’s highly active and includes the most active 3 sub-categories out of the entire list of 200 sub-categories. They are:

- Religious Services & Organizations

- Counseling Services

- Personal Coaching

A “Professional Services” category, a composite of various professional services traditionally provided in an office setting, is also highly active. This includes:

- Real Estate – Brokers & Agents

- Financial Planning and Investments

- Legal Services

- Tax Preparation

We believe the Professional Services category is ripe for a number of adaptive changes, given the feasibility of providing many of these services remotely. Their current level of activity is a harbinger of the quick evolution we see ahead.

Overall, change orders from small businesses in Support Services and Professional Services together accounted for 34% of total website change orders.

Source: vSplash data on website change orders mid-March to mid-April 2020.

We believe a multi-factor activity assessment at the category level is the most effective way to identify small businesses that will survive and thrive. Seeking out the initiative-takers is an approach repeatedly validated by previous experience. We look forward to sharing our findings and insights with you.