Building your Ideal Customer Profile (ICP) by putting in the right effort increases the chances of a successful account-based marketing program. With the proper expertise and account intelligence data, organizations like yours are generating revenue, making the most of their Total Addressable Market (TAM) while exceeding their sales goals. However, an ocean of data might fail to deliver a success story if your business decisions are largely based on the most readily available data rather than the set of signals most relevant to your business.

For instance, during the process of identifying and prioritizing your target accounts do you consider employee count as the primary signal?

See my latest findings between employee count and our own ICP, to illustrate how latching onto the easiest to capture data point isn’t necessarily the best one. Afterwards, you’ll probably reconsider the signal set you use to build your own ICP.

How an Easily Available Data Signal Can Sometimes Misinform your ICP Definition: A Closer Look

Many of you are using employee count in your definition of a target account. The more employees, the bigger the company, the more opportunity for you! Here at BuzzBoard, we found that over reliance on that one signal—one that people gravitate to largely because it’s easily available—is likely not the best approach.

So, why do you deem employee count as a de facto signal for your prospecting? Sure, if you sell a per-seat product, more employees probably means the potential for more seats. But it’s unlikely that’s the only, or single best, measurement of ideal-fit of a prospect account. Why do you allow this particular signal alone to convince you that any given account deserves priority in your TAM? Perhaps because this data is easily accessible—all kinds of data providers can give it to you! And perhaps, we have allowed ourselves some very strong association around it! That’s not a good reason!

In one of my recent analyses, I’ve gained a new perspective. At BuzzBoard, we used employee count as an indicator for our TAM as well. However, as a proxy signal, it turned out to be mostly meaningless to us.

Allow me to elaborate. At BuzzBoard, the most important attribute of a best-fit account for our prospecting is the number of records they maintain in their CRM—a rich digiographic signal that we most care about for our ICP. BuzzBoard’s account intelligence platform helps companies enrich and expand their CRM databases. By that logic, the bigger their CRMs, the more is their need for data enrichment, ensuring higher customer lifetime value for BuzzBoard!

However, CRM database size is not an easy-to-get data signal. Hence, employee count makes sense as a proxy signal for the size of their CRM database. Or does it?

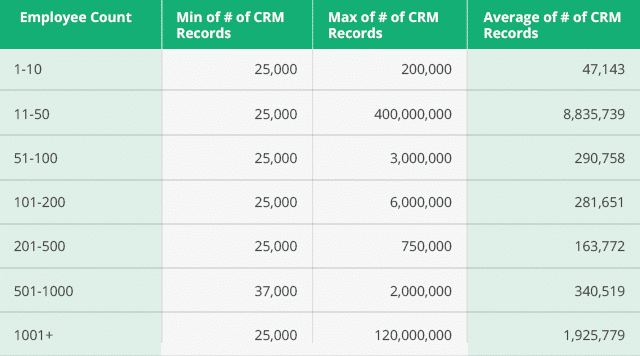

My analysis uses data from our annually published CRM data survey and supplemental data polling of our target audience This dataset contains roughly 400 records, including the number of employees, the employee count range, and the number of records in the CRM. This sample data set was used to study the correlation between employee count and the number of CRM records.

At BuzzBoard, we put the number of CRM records above employee count. Why? Because that’s the best indicator of fit to our ICP. There are undoubtedly better signals for ICP fit for your prospect accounts too!

Demonstrating the Correlation Between Employee Count and the Number of CRM Records

For the purpose of the analysis, I set the threshold at 25,000 CRM records which narrowed down the number of accounts to a little more than 300 and eliminated the smaller outliers.

# of CRM Records >=25000

Let us first review the results with the naked eye. If employee count is a good proxy signal for us, the rows indicating average number of CRM records would have increased as we go down–a basic analysis matching the average number of CRM records to employee count that shows no strong correlation between the two.

Our findings are further validated once I take a mathematical approach. Upon applying the correlation function to the same dataset with over 300 accounts, the result shows essentially ‘zero’ correlation. The number would have come out to be closer to ’one’ if there was a positive correlation, and in this case, it doesn’t.

So, are you making the same mistake with your ICP? Relying too heavily on a signal that doesn’t actually correlate to your best fit accounts?

The bottom line of this analysis is, loosely defining your ICP and assessing your TAM on high-level, and easy-to-source firmographic data may not always serve you well. Defining a robust, data-backed ICP requires a richer, digiographic account data set that keeps you spot on with your ICP and TAM.

So, are you still gathering and valuing employee count data to build your ICP just because that signal is the most readily available? And is it really a good, strong signal to identify ideal-fit accounts for your TAM and for prioritization?

Reach out to BuzzBoard, for we would be happy to dive down into this analysis and share more details with you. Let BuzzBoard find the real signals that are meaningful to your marketing and sales goals!

Do ‘like’, ‘share’, and ‘subscribe’ if you find our videos useful.